Conventional Loans

What is a Conventional Home Loan?

When the amount of the loan is within your county's loan limits and follows Fannie Mae and Freddie Mac guidelines, it is known as a "Conventional" or "Conforming" loan. The maximum Conventional loan limit varies by state and county and change yearly.

Conforming loans are required to adhere to the stipulations set forth by Fannie Mae and Freddie Mac, both of which are government-sponsored entities responsible for acquiring mortgage loans from lenders and subsequently trading them on the secondary mortgage market. Fannie Mae and Freddie Mac are designed to "offer liquidity, stability, and affordability to the mortgage market," as stated by the Federal Housing Finance Agency. They achieve this objective by releasing capital for lenders, enabling them to efficiently handle a greater volume of loans and assist more borrowers realize their dream of homeownership.

Typically, mortgage insurance (PMI) is required when borrowers put down less than 20%* on their home purchase. The PMI rate is influenced by two main factors: credit score and down payment. A higher credit score will result in a lower PMI rate, while a higher down payment will also lead to a lower PMI rate. Onshore Mortgage LLC has low down payment options available that allow you to eliminate this monthly PMI with a small increase in rate.

Conventional loans often have fewer restrictions on property types that can be financed. Single family homes, Condos, Manufactured homes, Multi-unit dwellings up to 4 units, and investment properties are all eligible as long as they meet certain income, credit and loan-to-value requirements.

What are the Requirements for a Conventional Home Loan?

Along with staying below the loan amount limits mentioned above, the borrower must also meet the following requirements to qualify for a Conventional loan:

Must have a steady income (new salary income can be used immediately with an income letter, hourly wage earners must have their income averaged over 24 months. If the trend of income is increasing, then the prior 12 months plus year-to-date income can be used).

Must have a good credit score, typically 620 or higher

Purchase and Rate & Term refinance to 97% loan-to-value for primary residence single family homes.

Multi family homes with 1-4 units being used as a primary residence can finance 95% loan-to-value.

A Conventional loan may be the ideal option for you if your credit profile and income meet the requirements and you wish to buy a new house in Fairhaven, Ma or the surrounding areas throughout Massachusetts and Rhode Island. A down payment as little as 3%* on a fixed rate term or 5%* on an adjustable rate are required on conventional loans.

What are the Benefits of a Conventional Home Loan?

Conventional home loans are the most common type of mortgage in the United States. Some of the benefits include:

A predictable interest rate and monthly payment for the entire term of the mortgage

Easy documentation requirements

Potentially faster closing times

Fewer restrictions on property “type” that can be financed with a conventional loan

Lower interest rates

High loan-to-value (LTV)

What are the Conventional Loan Limits in Massachusetts?

In Massachusetts, the conventional mortgage loan limits vary based on the number of units in the property being financed. It's important to note that these limits can change each year, so it's best to check back often to get the most up-to-date information. Additionally, while conventional mortgages are a popular choice for many borrowers, there are also other options available, such as FHA loans or VA loans, which may have different maximum loan limits and requirements. Ultimately, the best type of mortgage for you will depend on your individual financial situation and goals.

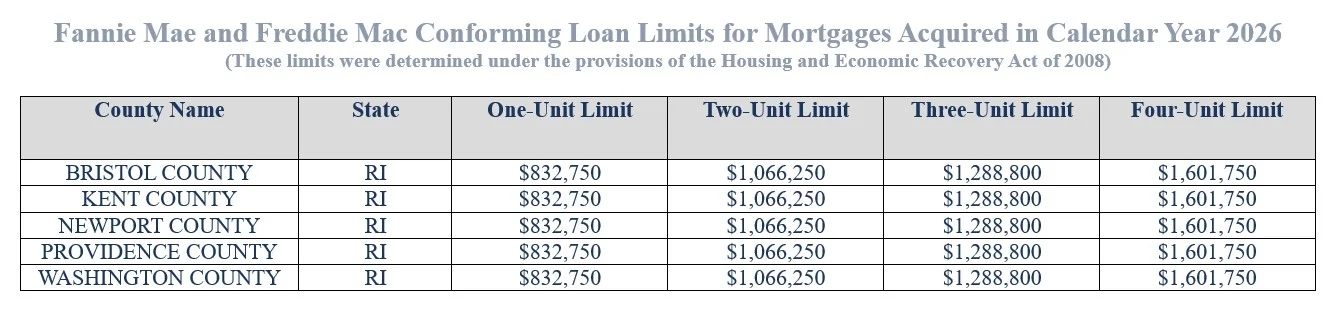

What are the Conventional Loan Limits in Rhode Island?

If you're interested in taking out a conventional mortgage in Rhode Island, it's important to keep these limits in mind to ensure you're eligible for financing.

What are the Types of Conventional Loans Offered by Onshore Mortgage?

Within the realm of conventional loans, two primary categories exist that are offered by our lending partners: Fixed-Rate and Adjustable-Rate Mortgages.

Fixed-Rate Mortgages: Maintain a constant interest rate throughout the loan amortization, offering stability and predictability. Common terms for fixed-rate mortgages are 15 and 30 years, which will provide a consistent monthly payment. Onshore Mortgage also has the ability to structure your fixed mortgage with any term you would like (30,29,28 etc). A fixed-rate mortgage is geared for borrowers planning to reside in their home for seven years or more.

Adjustable-Rate Mortgages (ARMs): These loans feature an interest rate that fluctuates over time. In the initial period, typically around one year, the rate remains fixed, leading to lower initial interest rates and monthly payments compared to fixed-rate mortgages. However, after the initial period, the interest rate may adjust—either increasing or decreasing—based on prevailing market conditions. The new rate is determined by adding your loans "Margin" to whatever "Index" it adjusts with. ARMs are well-suited for borrowers expecting to stay in their home for a short term 3, 5, 7, or 10 years before experiencing the interest rate adjustments outlined in the mortgage terms.

Additional Conforming Loan Programs Offered by Onshore Mortgage:

HomeOne: Discover Freddie Mac's HomeOne, an innovative low down payment conventional loan program crafted specifically for first-time homebuyers, regardless of location or income level. With no income limits and county restrictions, HomeOne boasts a down payment as low as 3%*. HomeOne also welcomes gift funds from family members. At least one borrower must be a first-time homebuyer (defined as no ownership interest in any property within the past 3 years), and complete a FREE, online first-time home buyer counseling certificate.

HomeReady: Similar to HomeOne, HomeReady presents an enticing option with comparable features, catering to first-time homebuyers. However, HomeReady introduces specific income limits, ensuring accessibility for a broader range of potential homeowners.Low income, First-time or repeat homebuyers can take advantage of this program as long as they are below 80% of the Area Median Income.

HomePossible: This loan is a great alternative to FHA financing for borrowers looking to purchase with a low down payment or refinance with limited home equity. Use the Freddie Mac Lookup Tool to see if your property meets the county loan limit requirement. Similar to the HomeReady program, borrowers must be below 80% of the Area Median Income.

If you're looking for a low down-payment mortgage option in Massachusetts, a Conventional loan may be the right choice for you. Contact Grant Menard today to find out more about conventional home loans and how they can help you buy your dream home.

*Credit and income restrictions do apply. Please visit our Disclosures page for a detailed breakdown of all loan types.

.webp)